Frequently Asked Questions

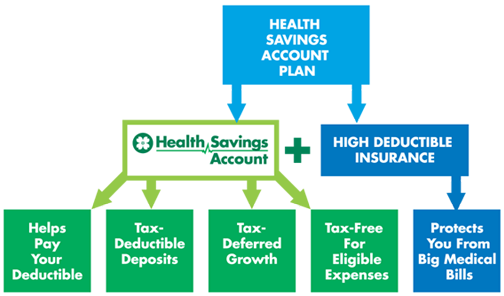

Your Health Savings Account (HSA) coupled with a High Deductible Health Plan (HDHP) can help you save money on your medical expenses. By choosing the HDHP you can save significantly on your health care premiums.

General Information

A Health Savings Account (HSA) is what you get when you combine a high-deductible health insurance plan and a tax-exempt savings account. They are designed to allow individuals to use pre-tax dollars to help pay for current and future medical expenses.

HSAs offer a triple tax advantage:

- Contributions are 100 percent tax-deductible for the account holder.

- Funds grow on a tax-deferred basis and funds are not taxed if used for an eligible expense.

- After age 65, funds can be used tax-free for eligible expenses, including Medicare premiums, or taxed with no penalty for other expenses.

Taking money out of your HSA is as easy as taking money out of your checking account. There are no claims to file - you simply swipe your HSA debit card or use Online Bill Pay. If you choose to reimburse yourself for eligible expenses, you can simply make a funds transfer using Online Banking, using Online Bill Pay or withdrawal funds at an ATM.

FSA: Employees fund their FSAs with pre-tax payroll deductions that lower their gross incomes and annual tax burdens. FSAs provide tax-free reimbursements for a broad base of qualifying healthcare and dependent care expenses, but money in an FSA does not grow.

HSA: Employees fund their HSAs through pre-tax payroll deductions that lower their gross incomes and annual tax burdens. Money in an HSA grows tax-deferred (funds can be invested in stocks and bonds), and reimbursements for qualified health-care expenses are also tax-free. This video can assist you with your benefit options.

Yes. Your HSA funds can be used for your spouse and dependent children's out-of-pocket eligible expenses, even if they are not on your health plan. Please remember that no one in your family can have a medical FSA if you have an HSA.

HSAs are individual accounts based on IRS rules. If you’re both covered by a qualified HDHP, you can each setup accounts or you can run all expenses through one account.

You need to spend the funds in your FSA by the end of the year, so you can be eligible to have an HSA at the beginning of the plan year starting January 1.

- No use it or lose it rules

- Unspent balances in accounts remain in the account until spent

- Accounts can grow through investment earnings, just like an IRA

Enrollment and Contributions

No. If you already have an account, CBC payroll contributions will continue to be made to that account anytime you are enrolled in the HDHP.

- Visit the Employee Self Service to set up payroll deduction

- Make a funds transfer through HSACentral.net or the HSA Central mobile app

- Visit a Central Bank branch

- $500 for employee-only coverage*

- $1,000 for family coverage*

Distributions from your HSA

(Please remember that standard email is not secure against interception. Do not include confidential information such as account numbers, credit card or debit card numbers or your social security number when sending email)